ETF Investment Strategies

Five distinct investment strategies utilizing ETFs traded on NYSE and NASDAQ, each with strong long-term performance and focus on sustainable growth.

Key Features

Long-Term Growth

Strategies designed for investors with 10+ year horizons seeking capital appreciation.

Strong Historical Returns

Each strategy has demonstrated a minimum 12% average annual return over 20 years.

Diversified Approach

Carefully selected ETF combinations provide exposure to different market segments.

Our Investment Strategies

High Growth Technology Focus

13.32%

0.16%

A strategy focused on high-growth technology ETFs that have consistently delivered strong returns.

ETFs in Strategy:

Balanced Growth Portfolio

11.44%

0.1558%

A balanced approach combining high-growth technology with stable large-cap exposure.

ETFs in Strategy:

Sector Rotation Growth

11.04%

0.1%

A diversified sector approach focusing on historically high-performing sectors.

ETFs in Strategy:

Multi-Cap Growth

11.43%

0.1995%

A strategy that combines large, mid, and small-cap growth ETFs for diversified market exposure.

ETFs in Strategy:

Global Technology Leaders

12.03%

0.1562%

A globally diversified technology-focused strategy combining U.S. tech leaders with international exposure.

ETFs in Strategy:

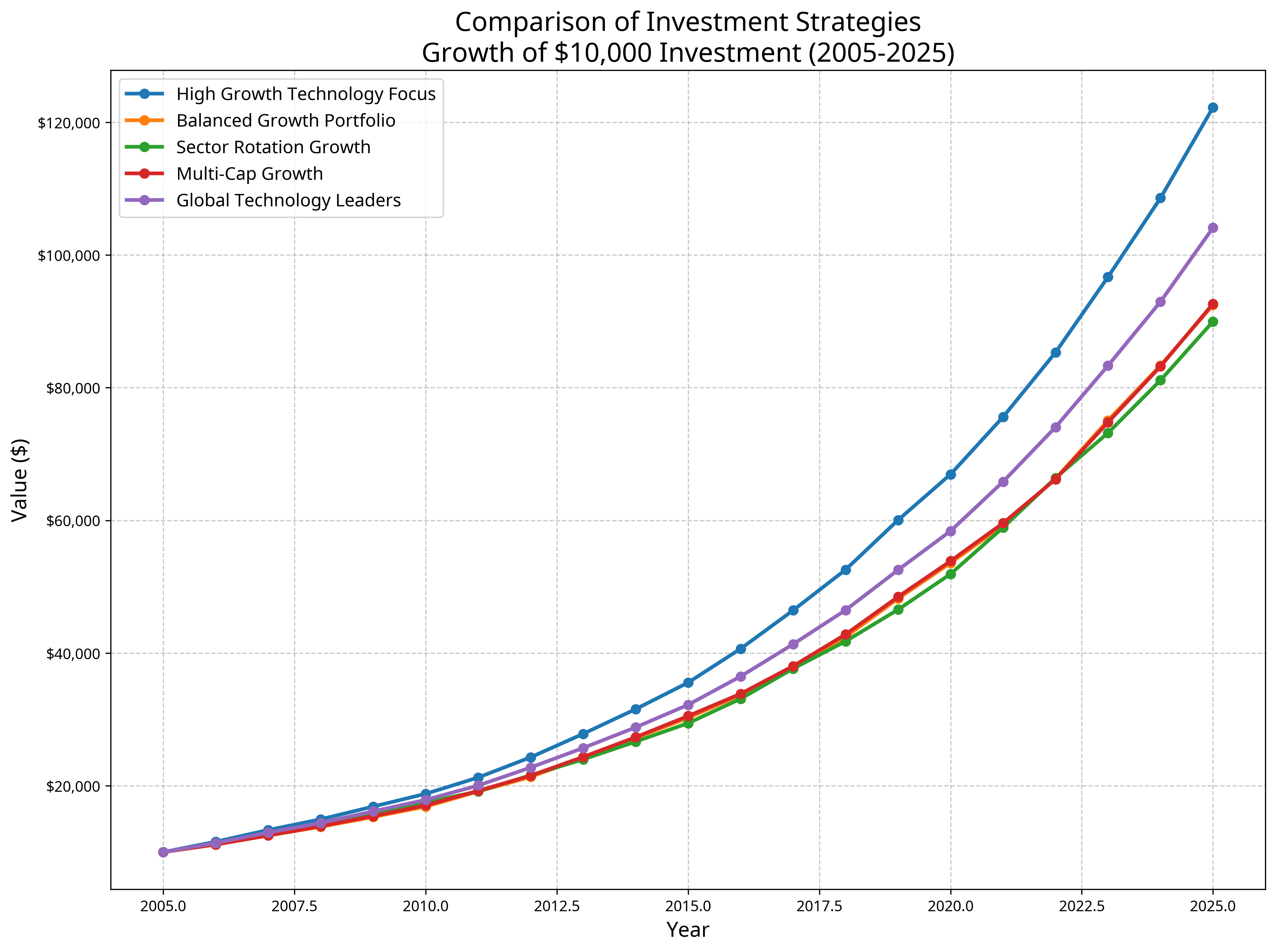

Strategy Comparison

Compare the performance of all five investment strategies side by side.